ETF Investing in India: The 2025 Guide for Smart Investors

Table of Contents

- Introduction: What Are ETFs?

- Key Features & Benefits of ETFs

- ETF vs Mutual Fund vs Stocks

- Pros and Cons for Indian Investors

- Current Trends in Indian ETF Investing

- Regulatory & Market Realities

- Who Should Consider ETFs in India?

- Actionable Tips & Best Practices

- Top ETF Investment Platforms in India (2025)

- Summary Verdict

- FAQ

- Glossary: ETF & Investing Terms Explained

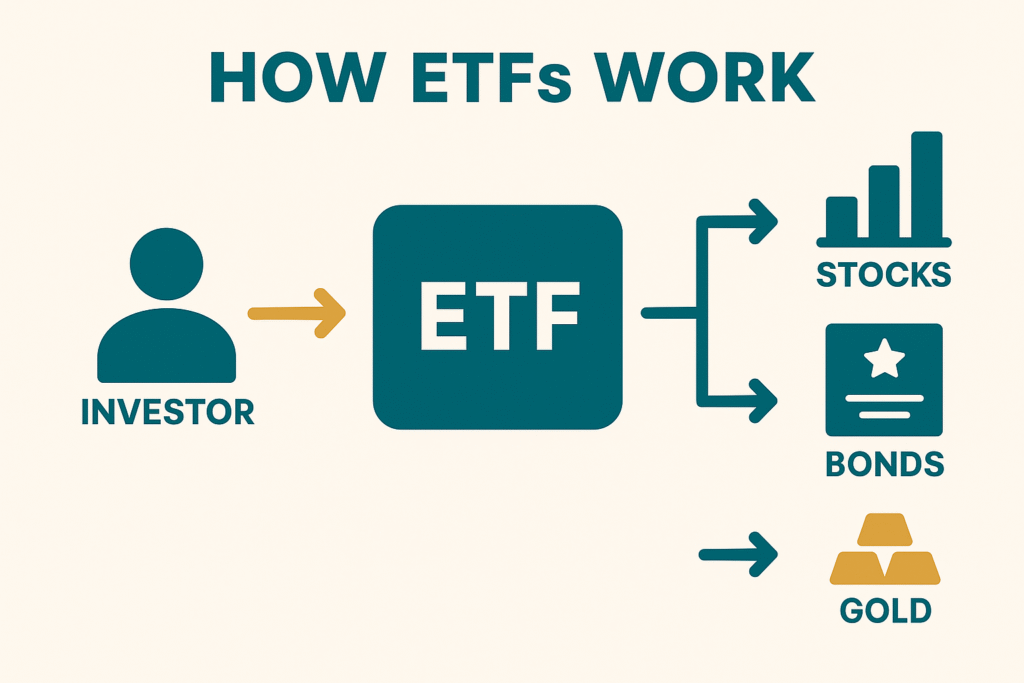

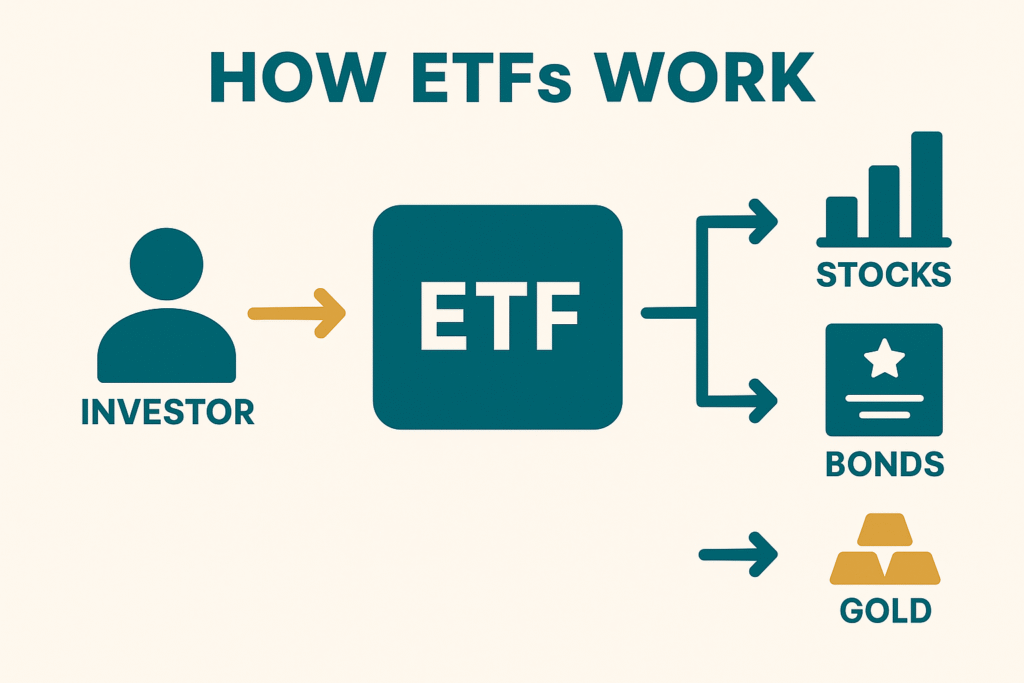

1. Introduction: What Are ETFs?

ETF (Exchange-Traded Fund)

A type of fund that owns a basket of assets (like stocks, bonds, or gold) and is traded on a stock exchange just like individual shares.

In India, ETFs let you invest in indices (like Nifty or Sensex), sectors (IT, Pharma), gold, bonds, and even global markets with a single click.

2. Key Features & Benefits of ETFs

- Diversification: Own dozens or hundreds of assets with one ETF.

- Low Cost: Lower management fees compared to many mutual funds.

- Liquidity: Buy or sell anytime the market is open.

- Transparency: You can always see what’s inside your ETF.

- SIP & Lump Sum: Invest a fixed amount monthly (SIP) or as a lump sum.

- Tax Efficiency: Fewer capital gains taxes than mutual funds in many cases.

- Global Access: Some Indian platforms allow investment in US/global ETFs.

3. ETF vs Mutual Fund vs Stocks

| Feature | ETF | Mutual Fund | Stocks |

|---|---|---|---|

| Diversified | Yes | Yes | No (unless you buy many) |

| Real-Time Buy | Yes | No (once daily NAV) | Yes |

| Cost | Low | Varies (often higher) | Varies |

| Minimum Invest | ₹500–₹1,000 | ₹100–₹500 | 1 share’s price |

| Taxation | Like stocks | Like stocks | Like stocks |

| SIP Option | Yes (on most platforms) | Yes | No |

4. Pros and Cons for Indian Investors

Pros:

- Instant diversification with small amounts

- Easy to buy/sell, no “lock-in”

- Lower fees than most mutual funds

- SIP available via top platforms

Cons:

- Needs a demat account (unlike mutual funds)

- Lower trading volume for niche ETFs

- No automatic reinvestment for dividends (unless you choose “growth” plans)

- Global ETFs need RBI approval under LRS

5. Current Trends in Indian ETF Investing

- Rapid AUM growth (total money managed in ETFs)

- Thematic ETFs: New funds for sectors like tech, clean energy, pharma, ESG

- Gold & Bond ETFs: Popular for balancing risk

- ETF SIPs: Growing use on platforms like Groww, ET Money

- International ETFs: Demand rising, with platforms like Kuvera & Vested enabling access

6. Regulatory & Market Realities

- SEBI-regulated: All Indian ETFs are approved by SEBI (Securities & Exchange Board of India).

- NSE/BSE Listed: You buy/sell ETFs on the National or Bombay Stock Exchange.

- LRS (Liberalized Remittance Scheme): Lets Indians invest up to $250,000/year abroad, including global ETFs.

- Taxation: Same as stocks—short-term (under 1 year) at 15%, long-term (over 1 year and above ₹1 lakh) at 10%.

7. Who Should Consider ETFs in India?

- New Investors: Want simple, diversified, low-fee investments.

- DIY Portfolio Builders: Like to manage their own money, choosing different ETF “building blocks.”

- Global Diversifiers: Wish to invest in US, China, Europe markets.

- Passive Investors: Want to match the index, not beat it.

8. Actionable Tips & Best Practices

- Start with index ETFs: Like Nifty 50 or Sensex for broad exposure.

- Use SIPs: Automate your investing and smooth out market ups & downs.

- Check liquidity: Only buy ETFs with good daily trading volumes.

- Compare costs: Look at the expense ratio and platform brokerage fees.

- Stick to regulated brokers: Only use SEBI-registered platforms.

9. Top ETF Investment Platforms in India (2025)

- Groww: Zero-fee demat, SIP in ETFs, easy app

- Kuvera: Direct mutual funds, US ETF access

- ET Money: Unified finance dashboard, strong support

- Zerodha: Pro-level trading, huge ETF choice

- Vested: Direct US ETF investing for Indians

- Upstox: Fast, affordable, user-friendly

- Paytm Money: Flat fees, multi-asset support

- Angel One: Full range, advisory tools

10. Summary Verdict

ETFs are a simple, flexible, and cost-effective way for Indian investors to access a wide range of assets—including international markets. If you want to build wealth steadily, start with broad-market ETFs using SIPs on trusted, SEBI-registered platforms.

11. FAQ

Q1: What is the minimum amount to start with ETFs in India?

A: Most ETFs can be bought for ₹500–₹1,000 or even less per unit.

Q2: Are ETFs safer than stocks?

A: Yes, because they spread your risk across many companies/assets.

Q3: How do I buy US/global ETFs?

A: Use platforms like Vested or Kuvera and follow RBI’s LRS process.

Q4: Do ETFs pay dividends?

A: Some do! You can choose “dividend” or “growth” (reinvestment) options.

Q5: What is an expense ratio?

A: It’s the annual fee (%) the ETF company charges to manage the fund—lower is better.

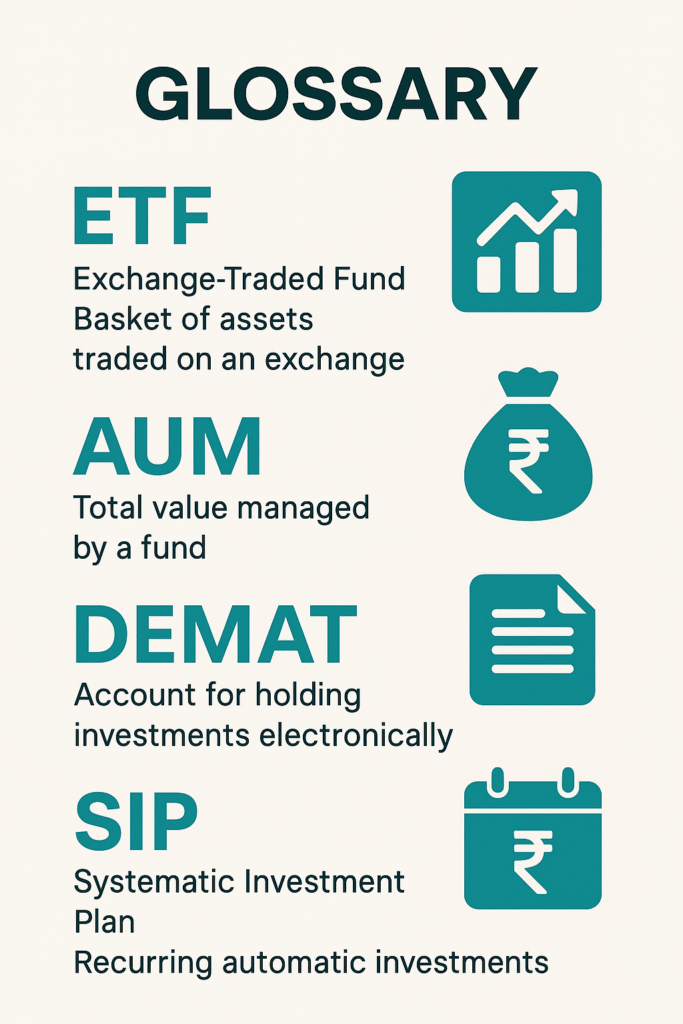

12. Glossary: ETF & Investing Terms Explained

- ETF (Exchange-Traded Fund):

A fund holding a basket of assets (stocks, bonds, gold, etc.), traded on a stock exchange. - SIP (Systematic Investment Plan):

An automated plan to invest a fixed amount at regular intervals. - AUM (Assets Under Management):

Total money managed by a fund or platform. - SEBI (Securities & Exchange Board of India):

The regulator that oversees India’s securities markets. - Demat Account:

Digital account to hold your stocks, ETFs, and bonds (no paper certificates). - NSE/BSE:

National Stock Exchange / Bombay Stock Exchange—India’s main share markets. - Expense Ratio:

Annual fee charged by the ETF provider, as a percentage of your investment. - LRS (Liberalized Remittance Scheme):

RBI rule allowing Indians to invest up to $250,000/year abroad. - Index Fund:

A fund (mutual fund or ETF) that aims to track the performance of a specific market index. - Tracking Error:

The difference between the ETF’s returns and the returns of its benchmark index. - NAV (Net Asset Value):

The per-unit value of a mutual fund or ETF, calculated daily.

Call to Action

Ready to build your wealth with ETFs?

Compare top platforms, open your demat, and start your ETF journey today!

For more guides, reviews, and ETF comparisons, visit nicheaihacks.com. Questions? Drop them in the comments below!